-30%

Accounting: Brevet A & B Zero to Hero

Rp500,000 Rp350,000

- Description

- Unit Outline

- Instructor

- Additional information

- Certificate

- Reviews (0)

Description

About this course

What you’ll learn

Estimate Time : 18 hours

- Pengantar Hukum Pajak

- Ketentuan Umum dan Tata Cara Perpajakan (KUP)

- PPh Orang Pribadi

- Pajak Pertambahan Nilai & Pajak Penjualan atas Barang Mewah (PPN & PPn BM)

- Bea Meterai (BM)

- Pajak Bumi & Bangunan (PBB)

- PPh Pemotongan Pemungutan (PPh POTPUT)

- Pajak Penghasilan WP Badan (PPh Badan)

- Pajak Pertambahan Nilai & Pajak Penjualan atas Barang Mewah (PPN & PPn BM)

- 10. Ketentuan Umum dan Tata Cara Perpajakan (KUP)

- Pemeriksaan Pajak

- Akuntansi Perpajakan

- E-SPT 4

![]()

TCSA Academic Team

Business Division

With both teaching and professional experiences, Our academic team has developed this content to bring you a comprehensive course that you build your competency to match the requirements in the professional environment.

Additional information

| Author / Publisher | Microsoft |

|---|---|

| Level | Beginner, Intermediate |

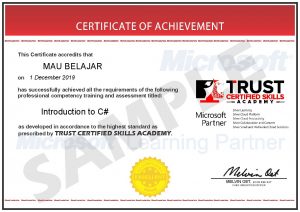

Certificate

When you enrolled into this course you will automatically get a Certificate of Achievement for completing the course. An example is provided below.

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.